city of richmond property tax rate

In Person at City Hall. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

Paying Your Property Taxes.

. To view the Total Homestead Tax Rates for Cities Villages in Macomb County please click here. These documents are provided in Adobe Acrobat PDF format for printing. Other Services Adopt a pet.

One Simple Search Gets You a Comprehensive Richmond Property Report. 295 with a minimum of 100. CITY OF RICHMOND TEXAS.

Real Estate and Personal Property Taxes Online Payment. Oct 1 2019. Informal Formal Richmond City.

The City Assessor determines the FMV of over 70000 real property parcels each year. Drop Box at City Hall. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

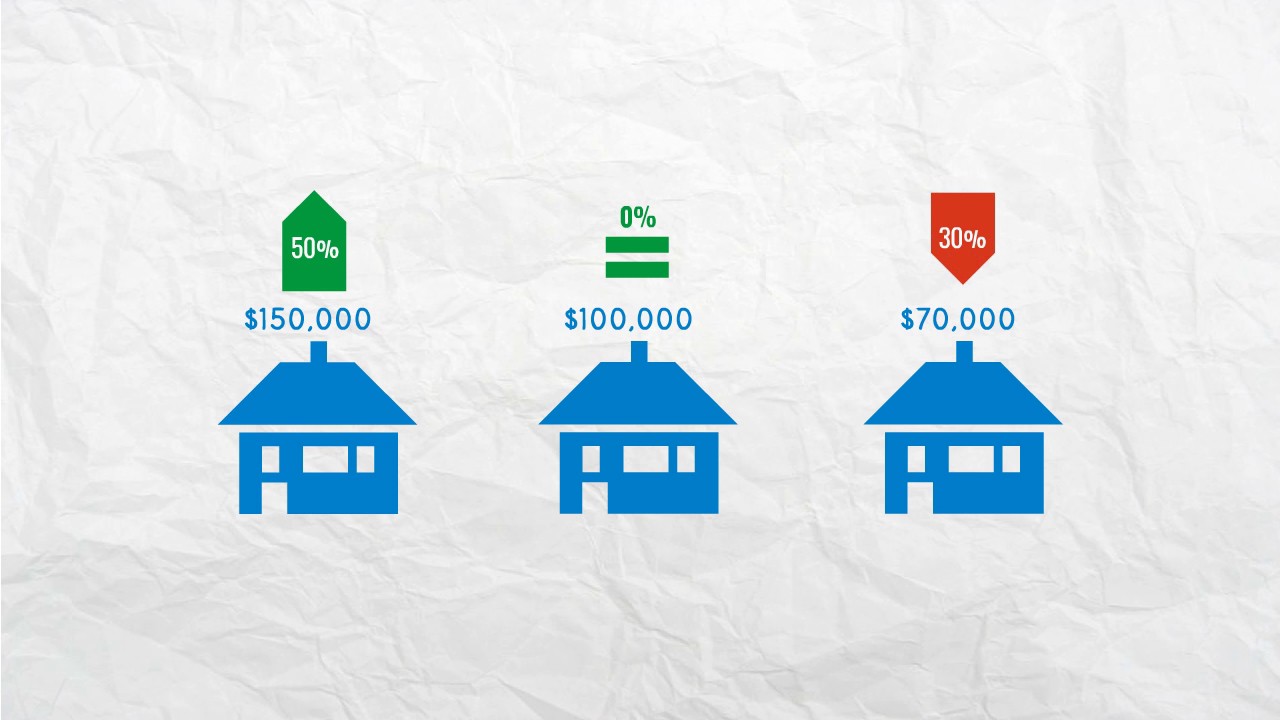

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Understanding Your Tax Bill. Macomb County Homestead Tax Rate Comparisons.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being. Property Tax Vehicle Real Estate Tax. See Results in Minutes.

Mon day July 4 2022. While our partners work directly with the Treasurer to provide resources or link our ambassadors to the community. Property Taxes are due once a year in Richmond on the first business day of July.

Other Services Adopt a pet. Ad Enter Any Address Receive a Comprehensive Property Report. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

Under the state Code reexaminations must occur at least once within a three-year timeframe. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. Property Tax Vehicle Real Estate Tax.

Building Department. Search by Property Address Search. Due Dates and Penalties for Property Tax.

Electronic Check ACHEFT 095. This budget proposes a flat property tax rate of 06999 per hundred dollar value for the fiscal year 2020. If you are interested in serving as an Ambassador or Partner please.

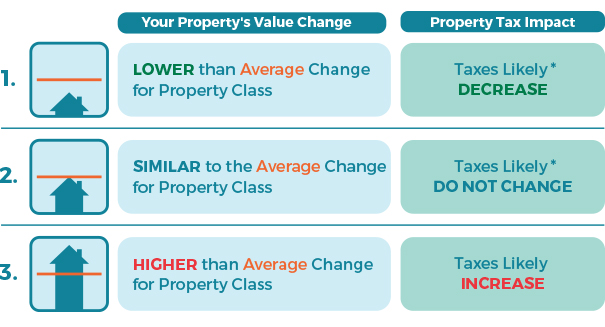

Manage Your Tax Account. Colleen Cargo City Assessor Email Richmond City Hall 36725 Division Road Richmond MI 48062 Ph. A 10 yearly tax hike is the maximum raise allowed on the capped properties.

It is estimated that by freezing the rate the city will provide Richmonders more than 8. Richmond residents will have until July 4 to pay their property taxes without. The City Assessor determines the FMV of over 70000 real property parcels each year.

Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website.

Property Tax Calculation Youtube

How 15 Canadian Cities Got Their Names Infographic Infographic City Canadian

10 States With The Lowest Median Property Tax Rates Hawaii Travel Guide Hawaii Travel Travel

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Ontario

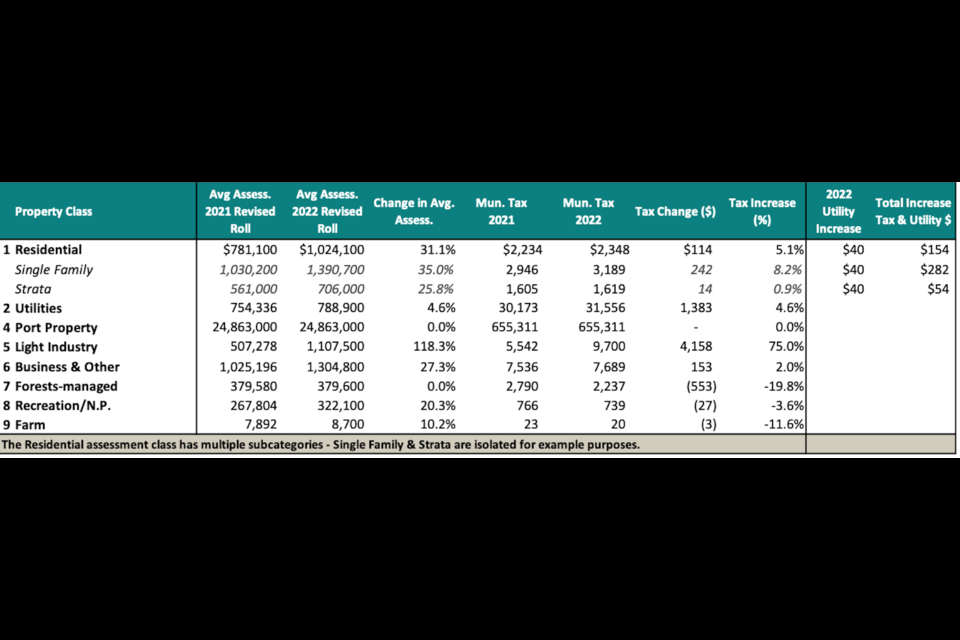

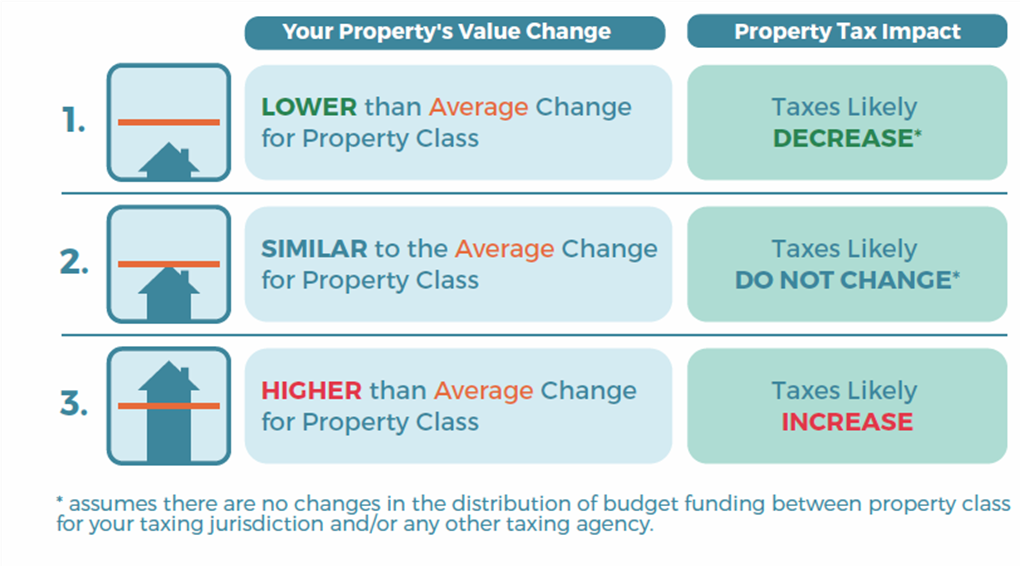

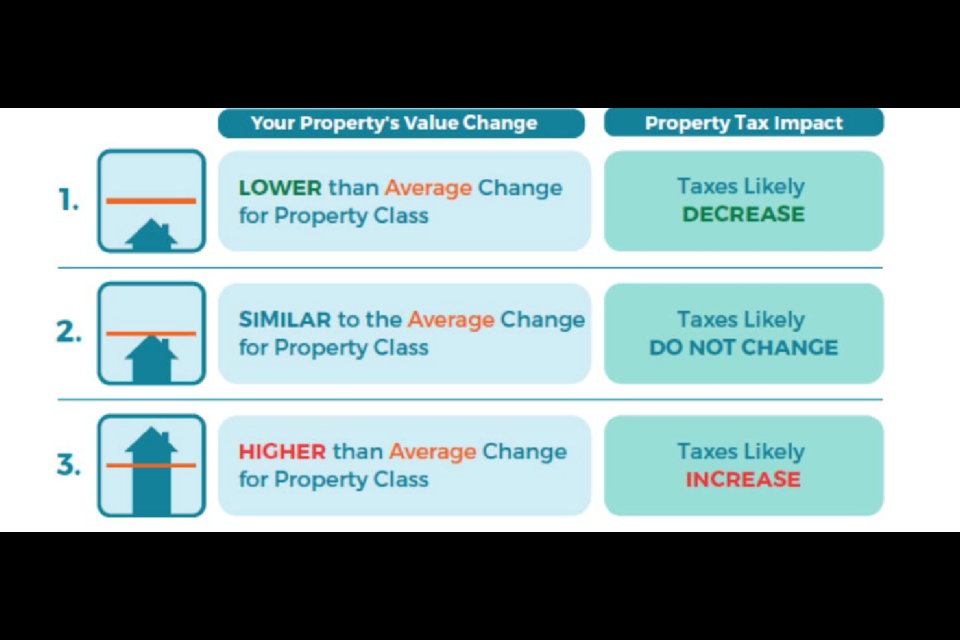

Lower Mainland 2022 Property Assessments In The Mail

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

About Your Tax Bill City Of Richmond Hill

Paying Your Property Tax City Of Terrace

How Much Are Squamish Property Taxes In 2022 Squamish Chief

Where Do I Find My Folio Number And Access Code Myrichmond Help

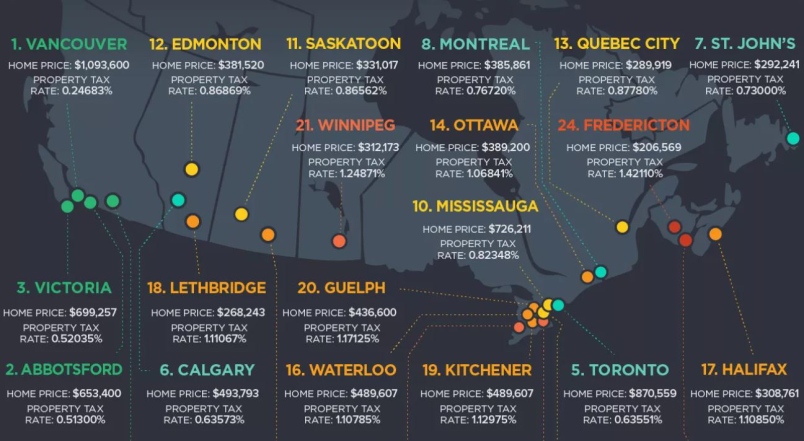

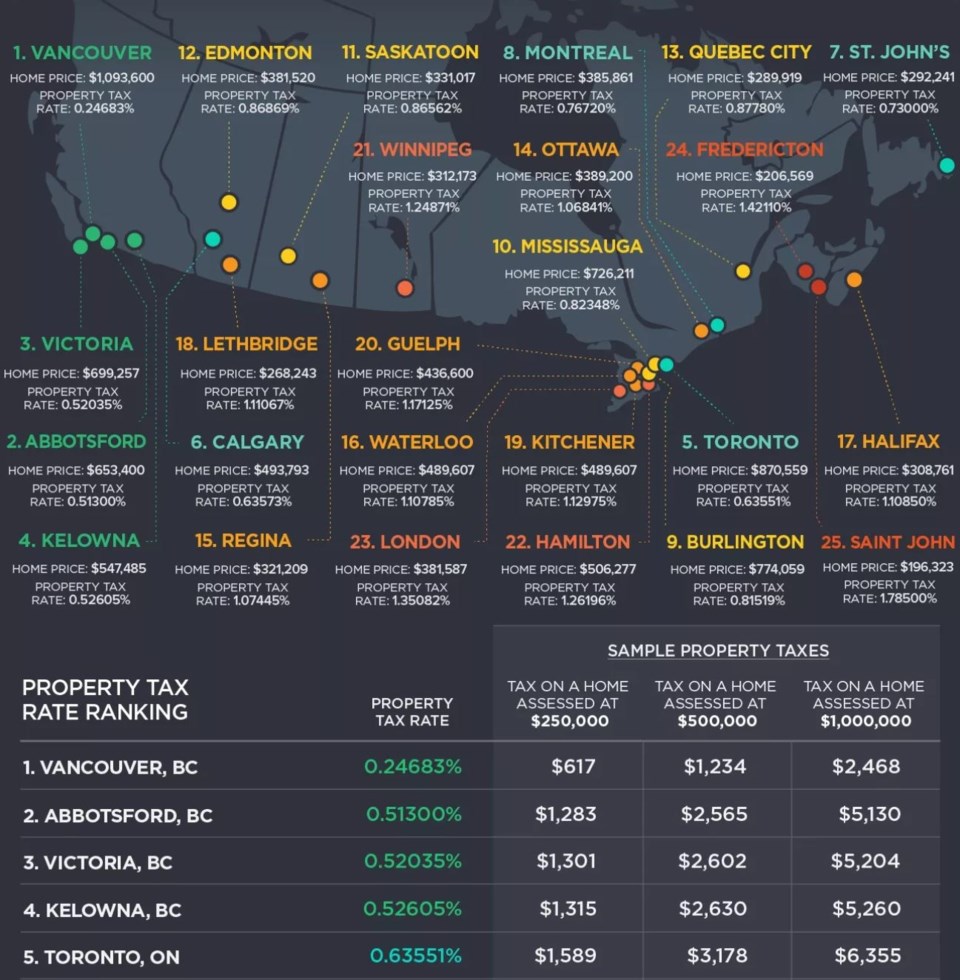

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor

B C Cities Have Canada S Lowest Property Tax Rates Infographic Western Investor